Report: Healthy lifestyle and financial security top list of employees’ well-being priorities

Data from Alight shows that workers are looking for balance and support in managing the stresses of post-pandemic life.

Red heart with shaped graph coin stacked and concepts a physical examination and health insurance.

Well-being can feel like an all-encompassing term. Of the myriad factors that go into “wellness,” there are a few that rise to the top for employees.

In a new survey from Alight, employees shared their top well-being priorities. Though there has been some movement since 2020, many top concerns remain.

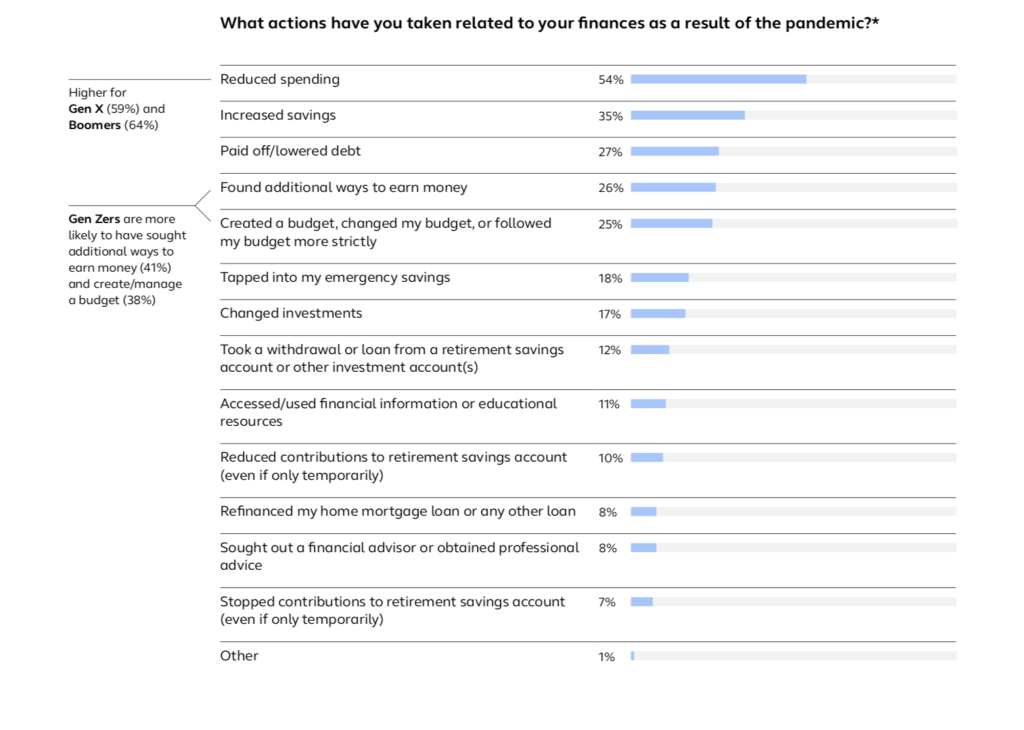

At the top of the list of concerns for 2021: living within a budget, or within one’s means. That tracks with the ongoing financial disruption that many faced with the onset of the COVID-19 pandemic, and as many aid programs designed to help people who lost income during the crisis have ended.

“Employees are least likely to say their financial well-being is going well relative to other well-being dimensions,” says Alight in the report. “But a significant portion of employees reduced spending and increased saving, which provided a foundation for improvement into 2021. It remains to be seen if this behavior will continue given pent-up demand for recreation, travel and delayed medical services.”

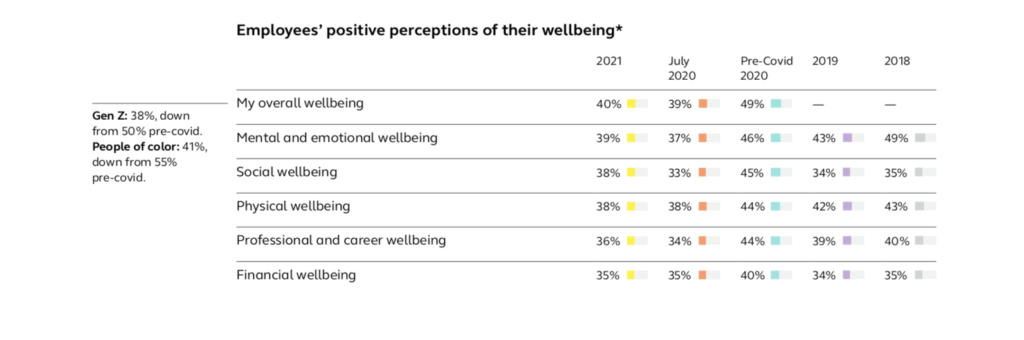

As vaccines have begun to unwind the consequences of the pandemic in some areas of the country, well-being perception for employees has increased. However, scores have yet to recover to their 2019 high-water marks.

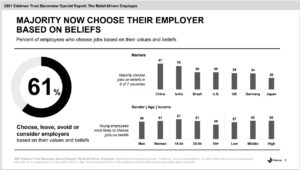

Employees patience for employers to get it right is waning. Respondents are much more likely to rate their employee experience (EX) as “bad” or “awful” in 2021 than they were in 2020 or in 2019.

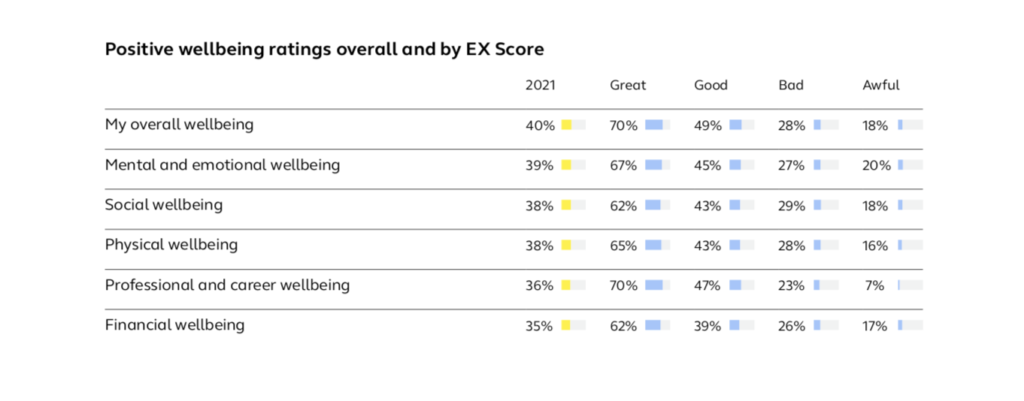

What’s more, the report clearly shows the link between employee well-being and “employee experience.” For workers who rated low levels of wellness, the experience as a worker in their organization is predictably poor.

Though financial wellness continues to be a sticking point for workers trying to come back from the financial crisis created by the pandemic, it’s important for would-be counselors and programs to avoid trite suggestions like “spending less” or “staying within your means.” The survey shows that many employees cut back on spending during the pandemic and or even sought ways to supplement income as budgets tightened.

The takeaway? Employees are desperately looking to regain their financial footing, and companies that offer financial wellness programs can create much-needed security for workers.

The report says:

“Employees who have financial well-being programs available through their employer are more likely to say they have control over their financial future than those without financial well-being programs available (56% vs. 42%).”

You can download the full report here.

COMMENT

Ragan.com Daily Headlines

RECOMMENDED READING

6 questions with: Stephanie Wilson of Wicked Creative

Wellness trends to watch in 2023

How to craft a wellness plan from A to Z

Tags: budgeting, employee experience, financial wellness, pandemic, well-being, Wellness