Curating the week in wellness April 26th–30th 2021: Replacing ROI with VOI, a cautionary wellness app tale, and more

The week’s essential content and fresh industry pickings for those dedicated to employee well-being.

Good morning, wellness warriors!

We hope you enjoy this week’s enriching content and thought-provoking articles.

As always, please get in touch with any ideas, suggestions or feedback on how we can serve you better. We are grateful for your partnership and for all the excellent work you do.

1. How’s your vaccine messaging going?

President Biden has announced a “new tax credit to fully offset the cost for small businesses and nonprofits who provide paid leave for employees to get vaccinated.”

The White House continues:

“As part of that effort, President Biden is calling on every employer in America to offer full pay to their employees for any time off needed to get vaccinated and for any time it takes to recover from the after-effects of vaccination. He will announce a paid leave tax credit that will offset the cost for employers with fewer than 500 employees to provide full pay for any time their employees need to get a COVID-19 vaccination or recover from that vaccination.”

Guidance on allowable vaccine incentives is still a bit murky. However, the law—and history—will likely favor those who err on the side of doing too much than too little. As HR Dive writes, “there are clear steps employers can take to incentivize more comprehensive employee vaccination,” such as:

- First, consider vaccine hesitancy and how it may be expressed among your workforce (use pulse surveys to surface your unique workers’ concerns or objections).

- Offer reasonable rewards for getting inoculated.

- Tie bonuses to vaccination.

- Offer complimentary, onsite vaccination.

- Provide PTO to cover time off.

- Team with rideshare services to provide transportation.

- Find clinicians in your community who can be trusted sources of information, who represent different members of your employee base and who can serve as resources when your employees have questions.

- Celebrating employees who have been vaccinated can both entice others to do the same and reward those who have completed their course.

As JD Supra writes: “Employers have a responsibility and an affirmative obligation to maintain a safe workplace.” Going the extra mile to help all your workers get the vaccine is an important step toward creating a safer, healthier workplace—and finally defeating COVID-19.

2. Instead of ROI, measure VOI.

Benefits Pro touts the importance of tracking “value of investment” on mental health programs. As opposed to chasing ROI, it’s better to monitor a more profound, progressive metric of investing in employees’ well-being.

Benefits Pro explains:

As Canopy Health, the physician- and hospital-owned medical network defines it, VOI “better reflects the broader financial impact wellness programs can have on an organization.” They argue — and we agree — that the value of a wellness solution can be measured in qualitative business attributes, including:

- Morale

- Recruiting

- Retention

- Employee engagement

- Productivity

- Presenteeism

- Positivity

Benefits Pro concludes:

Not sure where to start? A good beginning — and a place where brokers can help — is for employers to:

- Optimize what they already have.

- Invest in technology that delivers proven results and engagement.

- Choose a vendor employers and brokers trust.

- Do their research.

- Prioritize what matters.

3. It’s been one year since George Floyd was killed. Now what?

HR Executive offers seven strides your company can take to pursue more meaningful DE&I conversations, including:

- Companywide messaging should be helmed by CEOs and supported by leaders—not delegated solely to HR.

- Leaders should speak to their team, staff and suppliers before speaking out. (Wellness pros should exhort leaders to speak with diverse team members to gain a broad swath of perspectives.)

- Companies should offer the opportunity for their workers to connect with a licensed trained therapist in both same-race and cross-race conversations. (Consider hiring a Black therapist and/or a Black-owned company that does this sort of work.)

- Call for independent investigations of systemic racism within your own company.

4. A cautionary wellness app tale.

A piece in the Economic Hardship Reporting Project details a grocery worker’s “disturbing” experience with a corporate wellness app. The writer shares:

“The Rocket Health program’s primary function, then, is to provide the illusion of choice to workers who have no control over the conditions of their labor or to what might become of them after they are no longer useful to employers. As manual laborers, our working days are numbered no matter our “lifestyle choices.” That is what it means to sell your body for wages.”

Of course, accruing points and perks is nice—and there’s certainly a place for workplace well-being gamification—but what most workers want (and need) is cash:

“By participating in a corporate wellness, my fellow grocery store worker was able to follow a piece of advice offered by the program: do something nice for someone. But it turned out that what he really needed all along was not prodding from an app to get healthier. He needed the money.”

5. A peek at Ogilvy’s wellness program.

Campaign Live offers a peek at Ogilvy’s “100% You” plan, which “includes weekly Zoom seminars about four pillars: money, movement, minds and meals — to address financial, physical, mental and dietary wellness. U.S. employees have been given a time code to attend sessions, which are held during the work day.”

More about the program:

“Each month, sessions are led by one of four coaches: professional softball player and DraftKings host A.J. Andrews; founder and CEO of finance coaching platform The Financial Gym, Shannon McLay; Morrocan chef Yasmina Ksikes; and certified health coach and yoga teacher Yvette Rose.”

Additionally, here’s a peek at how Edelman, AXA and HPE are approaching wellness programs right now.

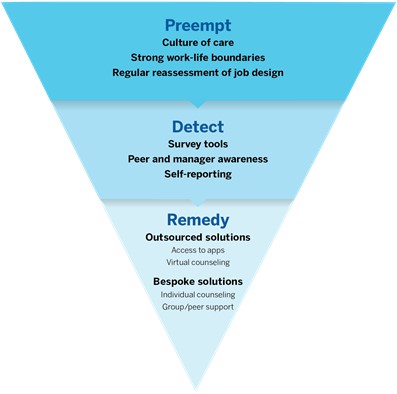

6. How to preempt workplace stressors.

Instead of taking a reactive approach toward employees’ mental health, employees can (and should) do more to prevent stress from building to a boiling point.

MIT Sloan Management Review recommends the following the “sieve model” of addressing mental health issues:

The piece also suggests taking concrete steps to help workers, including:

- Model wellness and balance for your team.

- Monitor workloads.

- Introduce a bookend to each working day.

- Revisit your company’s values and working culture.

- Actively listen to your employees.

- Embed wellness in the employee review process.

The piece concludes with this exhortation:

“As vaccinations become more available and some companies plan for their office returns, some people are starting to see the light at the end of the tunnel. But even in the best-case scenario, the pandemic will have left countless employees with mental health scars. Those scars require swift action and a profound but strategic rethinking of mental health support and how to create the right structures at the organizational level — now and in the post-pandemic future.”

7. The bottom-line value of bolstering employee well-being.

Aon’s 2021 Global Wellbeing Survey confirms that workplace wellness programs can bolster productivity, retention and profitability.

Aon’s data found: “When organizations improve employee well-being performance by 4%, they see a 1% increase in company profit and a 1% decrease in employee turnover.”

Aon also found that 82% of companies say employee well-being is “important,” though only “55% have a well-being strategy in place and just 24% fully integrate well-being into their business and talent strategy.”

8. 30 ways to help workers manage stress.

Tech Target lists a slew of tactics to help employees strike a healthier work/life balance, including:

- Set hours for email correspondence.

- Pony up for a home office budget.

- Provide discounts for meal prep services.

- Offer standing desk discounts.

- Try companywide gratitude challenges.

9. Pursuing more substantive financial wellness efforts.

CNBC has published a piece on the evolving role employers can play in their employees’ financial well-being. The takeaway? Employees need, deserve and expect, more direct support that goes beyond 401k’s and retirement plans.

The piece says employees are asking for “assistance with budgeting, emergency savings, debt management and financial planning programs,” though it’s crucial to tailor your program to suit your unique workers’ needs and preferences.

“Yet each company should listen to their employees and customize a program that suits their needs, said Lamm. In addition to basic financial principles, employers have also helped with identity theft, paying employees’ student loans and paying for advanced degrees.”